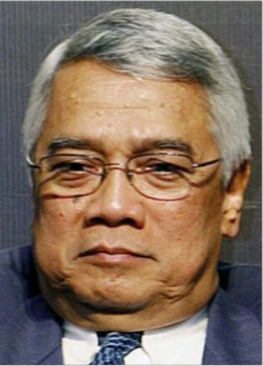

J Soedradjad Djiwandono: The Stock Market Reflects Poorly the State of the Economy

DEPOK – One of the points raised against the reactivation of the policy to limit the spreading of the novel corona virus decease (Covid-19) in Greater Jakarta, known in Indonesian acronym as PSBB, commenced on September 14, 2020 was that it was bringing down the Jakarta Stock

Exchange Index by 5 % as a Cabinet Minister said. I am not joining the debates on the policy itself, while always on the side of supporting the views and accepting any policy to fight the pandemic that are well thought out, based on data and information of medical science and public health as I happen to see this one now enforced.

I have also been writing op eds reminding all of us that the Covid-19 pandemic and the steps taken to fight it are both lopsidedly burdening the poor more. The virus inflicts suffering more relatively to the poor because of their embedded conditions, including preconditions in health. Meanwhile the steps to be taken in the policy fighting the pandemic, known as flattening the curve, also causes some burden or costs to bear – some called it misery curve – that borne by the poor relatively heavier or more. Just a simple illustration, if we make comparison between daily workers and regular workers, let alone the rich, a complete or even semi lockdown for one month for instance, the daily workers are out of work and immediately loss their income, but not the general workers. The government cannot overlook this issue in providing extra safety nets and in general, policies should aim at striking a balance between the flattening of the curve and this burdens or costs that fall relatively heavier on the poor. The poor are in dilemmatic situation, either falling sick from infected by the virus or similar suffering from devoid of livelihood.

My narration here is not about those, but on the economic issue which I think it is worthwhile to ponder. Following some writings about the working of the market in developed economies, the US, but also globally as well as anecdotal evidences, serious students in economics come up with argument that there is decoupling of the capital market behavior from the state of the economy. Let us discuss this issue, what does it mean and what are the implications.

Decoupling of the capital market from the state of the economy

I start by referring to an editorial opinion of well-known Hong Kong newspaper, The South China Morning Post (SCMP) of August 23, 2020 entitled “Stock Markets are divorced from the state of the global economy”. This paper suggested that the capital markets had been behaving strangely during this Covid-19 pandemic. The editorial stated that the New York Stock Exchange and Nasdaq in New York, with their famous index S&P 500 and Nasdaq Composite, Shanghai Stock Exchange with the Shanghai Composite, Hong Kong with Hang Seng Index and others, had been reporting bullishness, even record highs of their indexes despite all the scary news about the Corvid-19 Pandemic and its economic adverse impacts in recession and unemployment. The market players, investors and financers must be expecting and predicting better economy would be coming soon and forming strong demand for equities. The editorial seemed to opine that this is unrealistic, I think even sounded a bit cynical, stating ‘In the word of one well-known international investor, the markets are just nuts.’ (my Italic).

The editorial also made a strong note stating that at these levels, caveat emptor has never been more appropriate. Caveat emptor are Latin words which became the basis of trading contract of buying and selling of goods and services. It basically means that the contract is based with the understanding that the buyer takes his own risk about the quality of the goods he or she bought after the transaction is done. If the specification is not as he or she expected, so be it. Buyers could only ask for replacement if it is specified in the contract (receipt) that he or she could ask for refund or exchange for other good. In this context, this note sounds like a warning that investors have been wrongly making prediction and they will pay the price.

But that editorial is not the only one making this argument. A well-known economist from Yale University, Prof. Robert Shiller wrote a paper making similar argument in “Understanding the Pandemic Stock Market (Project Syndicate, July 7, 2020). In this paper Prof Shiller also demonstrated that the stock markets in the US were behaving very strange, contradicting what came out from genuine news and theory. He further wrote that the worse economic fundamentals and forecasts become, the more mysterious stock-market outcomes in the US appear. So, when genuine news suggests that equity prices should be tanking, the stock market indexes hit high. He offered alternative explanations based on crowd psychology, the virality of ideas, and the dynamics of narrative epidemics which could shed some light.

When we dig a little further we would find that the question about the accuracy of reading the development of the movement and volatility of stock market indexes as a predictor for the state of the economies associated to the capital markets has been historical. The SCMP editorial did not miss mentioning this issue by quoting from a bit cynical quip of the late Economic Nobel Laureate in 1970 Professor Paul Samuelson of MIT that the stock market hadpredicted nine of the past five recessions. What he meant was that the stock market was a poor guide to tell us about the state of the economy. There is a decoupling or divorce between market and the state of the economy, both nationally and globally. This is certainly not saying that we should not monitor or study the behaviour and the dynamics of the stock markets of course. But do not take the volatility of its index as necessarily reflecting the state of the economy.

But what does the dynamic of stock index reflect of then?

For sure the authorities responsible for the management of the national economy and development should be concern and study carefully the ups and downs and the general behaviour of the stock market. This is part and partial of their jobs and responsibility; to address the issues, to calm down the market, to deal with the adverse implications to reduce uncertainty and maintain stability.

Due to the dynamic of market behaviour, both domestic and globally all the stakeholders cannot afford to behave like business as usual. Here, what I alluded above is important that we are all aware at the least. Economics is less and less hard science as some strongly believe. The bullishness of stock markets which is supposed to show that economy would rebound shortly, which responsible news and serious economists argued to be flaw as mentioned above should not be ignored, just like data and advises from public health doctors regarding Covid-19 cannot be ignored.

The bullishness of the capital markets as reported in the news of the record breaking surges of stock indexes could be explained better from the aggressive policy taken by monetary authorities in support of the extra ordinary government spending as undertaken by many countries, even globally to fight the Corvid-19 pandemic that had to be done when the fiscal space has been weak in most countries due to past budget deficits and Debt to GDP ratios that have been high at the outset. In the US during the GFC in 2008 in the span of two years the Fed poured into the economy more than USD 3T of additional liquidity. In 2020 approximately similar amount of liquidity was added to the economy within several months. Similarly, in Europe, the ECB in EU and the BoE in UK copied this policy, adding liquidity into the European economies tremendously.

Much of these additional liquidities have not been flowing to the society for public to spend. So, there has not been any impact on general prices let alone hyperinflation as conventional monetary analysis would predict. They are still in the hands of big corporations and financial sector. In my view, these are what seem to be the liquidity that poured into the capital markets and drive stock indexes up and up sky high. Popular explanation saying that capital markets behave like that because they are dominated by speculators or that capital markets work like casinos is not helping us understanding the issue.

However, it is correct to say that this development has been used as ammunition in politics for the incumbent to justify claim of good economic performance, as we kept reading the news about President Trump making self-congratulatory remarks for his success in managing the US economy during campaign rallies for hisre-election. But, for Democratic Candidate Joe Biden, this is a cover up of the reality of the dismal performances of President Trump in managing the fight against the pandemic and the economy, which sounds more likely.

Serious news, data and economists demonstrate that the capital market development does not necessarily reflect the real sector and the state of the economy. It has also been in the news that the world- famous investor Warren Buffett has not been making any investment in the form of buying stocks this year. He said that he has not been finding any equity worth buying at this time, they are mostly still overpriced. In other words, he is on the same page as those serious economists like Prof Shiller who argued that the US economy is facing long struggle to make economic activities return to normalcy. Recovery may well be in L-shape rather than V-shape.

I would like to end my narration by making a conjecture regarding the argument for directly relating the announcement of the reactivation of PSBB to cause an adverse impact economically, a 5 percentages downfall of the Jakarta Stock Index. I take this criticism as arguing that the downfall of the stock index was directly caused by the PSBB policy announcement. My narration showed the tendency in developed economies, in fact globally that there has been a decoupling, even divorce of the capital market from the state of the economy. The studies referenced or cited are cases of increase in stock price indexes. But there is no strong reason to argue that any difference would result in reverse cases of stock index downfall either. (hjtp)

Source: Op ed, Independent Observer, Sep 25-Oct 1, 2020.