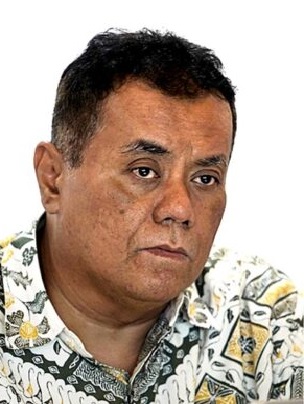

Ari Kuncoro: Indonesian Economy Welcomes 2020

Without feeling the end of 2019 is near, briefly in 2020 will be published in the eastern horizon. It is undeniable, 2019 is a tough year for Indonesia.

Without feeling the end of 2019 is near, briefly in 2020 will be published in the eastern horizon. It is undeniable, 2019 is a tough year for Indonesia. Three important events occurred, the US-China trade war, the 2019 Presidential Election, and the prospect of a US and world recession.

Macroeconomic data publication by the Central Statistics Agency (BPS) is only available until quarter III-2019. At that time, the economy was seasonal at a nadir, both because of the business cycle and the political cycle.

As a result, to look forward, it cannot be done just by looking at trends, but requires a number of leading indicators, such as the consumer confidence index (IKK) issued by Bank Indonesia which consists of the Economic Condition Index (IKE), the Consumer Expectation Index (IEK).

Another indicator is the purchasing manager index (PMI), which is useful for detecting the production side of the economy through the behavior of procurement of goods, both for the next production process and resale.

Unless there are extraordinary events, the indices generally have a recurring pattern each year, although the maximum and minimum scores may differ according to the development of the external environment.

Economic Behavior

From the demand side, two important variables are consumption and investment which together make up about 85 percent of GDP products. The general pattern after the 1998 Monetary Crisis shows that investment follows the prospects for growth in public consumption rather than vice versa. This is in line with the increasing number of middle class people in middle cities such as Makassar, Semarang, Yogyakarta, Solo, and others.

Data for the third quarter of 2019 showed that consumption growth slowed from 5.05 percent to 5.02 percent on an annual basis. The highest component was expenditure on education and health, followed by hotels and restaurants, which grew 6.6 percent and 5.8 percent respectively.

While other components such as clothing and footwear, household equipment, and transportation and communication are below the growth of gross domestic product (GDP). At the same time, the IKK value reached its lowest point in October 2019, which was 118.4. This pattern is similar to the purchasing index for durable goods (IPBT) which recorded a score of 108.9, a significant decline from 111.7 in the previous month. November 2019 was a turning point, with the IKK value significantly improving to 124.2 with improvements in all its components.

IPBT also improved in all income groups and age groups. IPBT has an improved pattern at the end of the year which continues until the first and second quarters of the year. The shift of Eid al-Fitr is getting closer to the months at the beginning of the calendar year to slightly shift the time of this behavior.

The new pattern shows, in the second quarter the purchase of durable goods began to be put on the brakes to save for vacation trips around holidays with Lebaran. For 2019, IPBT peaked in February, then declined in March and then began to increase again to reach the highest score in June along with the month of Eid.

After that the consumer community took a breath for several months replenishing their savings coffers. After July, IPBT figures declined again to finally reach the lowest score in October. IPBT experienced a rapid recovery in November so that it almost reached the index as in February 2019.

Positive coverage in the mainstream media and social media about trade peace and the possibility of recession is getting smaller, seems to have an influence on this behavior.

PMI production side behavior is captured as an early indicator of investment behavior. Values below 50 reflect a pessimistic horizon. Conversely, the higher the index to above 50, the higher optimism about the economy going forward.

Along with IPBT, May 2019 recorded the highest PMI of 51.6, in anticipation of the potential for high demand during the Lebaran month. However, for the following months the PMI consistently continued to decline. In July the score was below 50, then reached its lowest point in October, which was 47.4.

Investment growth which declined to 4.21 percent in quarter II-2019, from 5.01 percent in the previous quarter, reflects this. November 2019, in line with the development of the IKK, PMI has improved to 48.2. Even though the score still remains below 50, producers seem to start moving into the optimistic zone.

Riding a Wave

As with surfing, how the economic prospects of 2020 will depend on how the government uses the first two quarters to maintain momentum (riding the wave).

The completion of the omnibus law to reduce business and investment barriers is expected to be completed at least in the second quarter of 2020, including derivative regulations. The faster the better to utilize the cycle that is moving upwards. Other benefits are increased ease of doing business, increased investment efficiency through decreasing the amount of incremental capital output ratio (ICOR), and improving economic structure.

From the 2014-2019 period, in order to create a multiplier process, the lessons learned so that infrastructure development is more optimal is to involve more the private sector. The government’s plan to limit the role of children and grandchildren of BUMN companies will increase private business opportunities so that the marginal propensity to invest increases. A new supply chain will be formed.

With these two combinations, the process of doubling people’s purchasing power will increase so that it is not impossible that a growth rate of 5.3 percent or even more can be achieved. As stated in this column before, the highest growth in real investment since 2013 was 7.94 percent, occurring in quarter III-2018. For the economic growth target of 5.5 percent per year, the investment growth needed is around 9 percent per year.

The upward growth cycle is expected to begin with spending on health and education as well as spending on hotels and restaurants on the consumption side. On the production side, the health and social services sector as well as transportation and warehousing will precede recovery.

The trade sector will follow, followed by the manufacturing sector when purchases of durable goods are expected to recover in the first quarter of 2020. Economic growth will probably slow down in the third quarter after Lebaran because people need time to accumulate savings to the desired level.

As compensation, the government can again carry out fiscal stimulus to maintain momentum until the cycle rises again at the end of quarter IV-2020.

Prof. Ari Kuncoro: Rector of the Universitas Indonesia, Professor of the Faculty of Economics and Business, Universitas Indonesia.