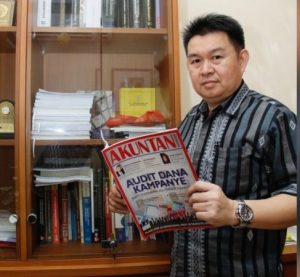

Budi Frensidy: Gaining Financial Freedom

Nino Eka Putra ~ FEB UI Public Relations Officer

DEPOK – Monday (14/9/2020) Kontan daily published an article written by Budi Frensidy, professor of finance and capital market, FEB UI, entitled “Gaining Financial Freedom”, in its Bourse – Wake Up Call column. Following is the complete article.

“Gaining Financial Freedom”

What is the difference between wealthy and prosperous? Being rich means having more asset or wealth than the average person.

Actually, it is more prudent to measure wealth as net asset minus debt. In this era of credit card, personal loan (KTA) and other non-cash expenses, a lot of people may seem rich because their net asset is relatively small and most of their asset is financed by debt.

Meanwhile, prosperity is how long an indivual can maintain his/her standard of living without his/her or other family members having to work. Prosperity is the ability of the cashflow from productive asset or passive income can cover an individual’s lifestyle. If a unit of wealth is the rupiah, a unit of prosperity is time (month or year).

If your monthly expenses are Rp8 million and your liquid asset is Rp200 million, you can survive a normal life without having to work for 25 months. If your asset is productive asset, you can survive longer than 25 months without having to work.

If your asset can support your life for the next several decades or yields a cashflow of more than Rp8 million per month as mentioned above, you have achieved financial freedom. You are not financially dependent on anyone at anytime.

A rich individual is not necessarily prosperous, let alone financially independent. Ideally, we should gain financial freedom rather than wealth.

A lot of people believe that money is the main problem in life so they think that having more money will help them solve their problems. What happens in that when your income increases, your expenses also increase.

This kind of people will not become more prosperous. On the contrary, they will be further and further away from achieving financial freedom. They forget that the most important thing is not how much money you have, but how long your money can cover your expenses.

There are people who become rich after winning lottery tickets worth millions of dollars, getting an inheritance or becoming celebrities. However, they do not understand the power of money and cannot control themselves. The money they get easily is gone in a flash.

Instead of buying productive asset, such as stocks, bonds or property to rent, they buy a bigger house and an even more luxurious car. In the end, the money is gone in a flash and they are once again in debt.

I see how a lot of people are controled by money. I believe it is more prudent for us to take control of money rather than being controled by money.

If your Rp 1 billion Rp 2 billion house is comfortable, why buy a bigger, more expensive one? And by obtaining a loan at that! The normal value of our house is 20%-30% of our total wealth.

Buy productive asset instead of consumption asset. Houses and cars are an obligation rather than an asset.

A house or property to rent that yields an annual return of around 8% is an investment. But a house to live in or one that is not leased is an obligation. Productive asset yields revenue while consumption asset results in expenses.

Buy a bigger house and a new car only after you achieve financial freedom. You can use the yield from your stocks, bonds, business and property to buy your dream house or car.

Unfortunately, we only have data on the wealth of the citizens of a country. There are no data on prosperity, probably because there is no set standard to measure prosperity.

The Global Wealth research conducted by Credit Suisse (2019) revealed that 172.9 million adults in Indonesia only have an average net wealth of $10.545 (around Rp155 milion), consisting of $4.767 of financial asset, $6.506 of real asset, and $729 of debt.

Wealth and income are never distributed normally but slant upward. The median wealth of the average adult in Indonesia is only $1.977 (Rp29.1 million).

In Indonesia, only 106,000 people or 0.1% have a net worth of more than US$1 million and can be classified as millionaires in US dollar (see table), far below other countries.

The key to true financial freedom is not to be in the top 0.1% but self-control and the ability to differentiate between want and need. Money can never fulfill your obsession to meet all your wants.

Financial freedom is the result of a mental process of how you view money. Make money ‘work’ for you so that you can achieve financial freedom. (hjtp)

(lem)