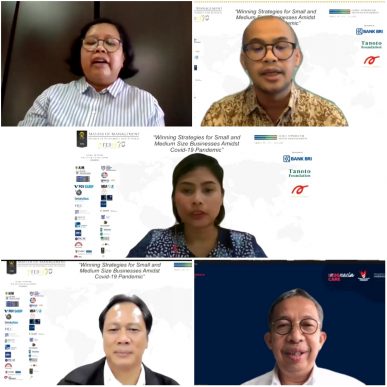

MM FEB UI, GNAM 2020: Winning Strategies for Small and Medium Size Businesses Amidst Covid-19 Pandemic

Nino Eka Putra ~ PR of FEB UI

DEPOK – Every year in March and October, more than 750 students from the Global Network for Advanced Management (GNAM) member universities in 30 countries participate in Global Network Week (GNW) activities in various countries. In 2020, MM-FEB UI will again host the Global Network Week for the 10th time, on 19-23 October 2020. This year, facing a pandemic and based on the agreement of all GNAM members, GNAM Week in October 2020 was conducted online, with the theme “Winning Strategies for Small and Medium Size Businesses Amidst Covid-19 Pandemic”.

Students who take part in the GNW program, visit other GNAM member universities, and interact with various countries, cultures and economies. Students who take part in the MM FEB UI activities this time come from UNSW Business School (Australia), Fudan University School of Management (China), IIMB – Indian Institute of Management Bangalore (India), Lagos Business School (Nigeria), Koç University Graduate School of Business (Turkey), PUC Chile and the National University of Singapore. Apart from the 13 foreign participants, the GN Week activity was attended by around 66 MM FEB UI and PPIM FEB UI students, as well as 7 other MM students from all universities in Indonesia.

The first day of GNAM Week 2020, Monday (19/10/2020),

Dony Abdul Chalid, Ph.D., Head of the Management Department of FEB UI, in his speech said that MSMEs are currently struggling to survive amid Covid-19. The government has made efforts to assist MSMEs with the PEN scheme in the form of grants, KUR relaxation, interest subsidies, working capital, and the Presidential Ban. In addition, MSMEs must go digital to survive. This is in line with information from the Ministry of Cooperatives and Small and Medium Enterprises, that only around 13% of MSMEs have gone digital. Meanwhile, the tourism and creative sectors were also affected, causing tourist arrivals to fall by around 30% at the start of the pandemic and the occupancy rate to experience a decline of nearly 70%.

“This October, the GN Week 2020 program at MM FEB UI, invites competent speakers to give their views in dealing with these problems. These speakers include figures, such as ministers, regulators, decision makers, and CEOs of the largest companies in Indonesia. In addition, the participants will also experience the development of sustainable tourism at the center of Indonesian tourism, namely Bali. I hope that the GN Week 2020 event can provide valuable insights, knowledge, and experiences. Thank you for your participation in GN Week organized by MM FEB UI,” said Dony.

Prof. Rofikoh Rokhim, Ph.D., Head of the FEB UI Master of Management Study Program, said that this year’s GNAM chose a special topic regarding MSMEs and tourism in the pandemic era. “We have 3 days of discussions with leading industries engaged in the UMKM sector. Here, we can find out the problems that occur in MSMEs, both in terms of business processes, marketing, export-import and finance. The Indonesian government has made concessions on the banking industry, namely in terms of lending to MSMEs and will be discussed with Agus Rachmadi from BRI. On the other hand, we also discussed several industries affected by the pandemic, namely the commercial and tourism industries and we have invited the CEOs of the airline industry to give their views. Hopefully this GN Week will provide insight to all participants. Welcome to follow,” Rofikoh said.

On this occasion, Rofikoh also expressed his gratitude to sponsors from Bank BRI, Tanoto Foundation and Arwana Ceramics who have supported the GNAM Global Network Week 2020 program.

Session 1: Setting up the Scene; Covid-19 Impact on Indonesian SMEs and Government Policy

Wawan Russiawan, Director of Strategic Studies, Deputy for Strategic Policy at the Tourism and Creative Economy Agency, explained that the Covid-19 pandemic has an impact on the tourism industry in the world, causing a decline in international tourists worldwide between 850 million – 1.1 billion (-58% up to -78%), lost revenue of US $ 910 million -1,200 billion from the tourism industry, and risk of losing 100-120 million jobs (source from UNWTO). This happens, because the pandemic raises concerns on the health aspect. From there, they chose to stay at home rather than having to travel or take a walk to avoid the spread of Covid-19. Meanwhile, tourism and the creative economy can recover in the new normal era by implementing health protocols and convincing middle and upper class people to visit tourist destinations that provide a sense of security and comfort.

The Ministry of Tourism and Creative Economy (Kemenparekraf) implements a policy stimulus in building supply and demand in the new normal era in the form of preparation of tourist destinations, implementing and monitoring health protocols, building an image for a sense of security and comfort that attracts market interest, providing stimulus packages for tourism / tourism grants, optimization of MICE activities of ministries and government agencies in tourist destinations.

Wawan added, Kemenparekraf also builds connected infrastructure that is competitive with other countries, provides BLT to micro and UKM tourism and creative economy, improves the quality of human resources, and expands tourist connectivity. The main target locations for tourism and creative economy recovery are focused in the areas of Bali, Banyuwangi, Riau Islands, Central Java / DIY. It is time for Indonesia to have its own connectivity, not depending on other countries, so that we can become the center of economy and tourism in Asia and even the world.

Session 2: Covid-19 and SME Banking – How Indonesian Banks Manage its Businesses Amidst Covid-19 while Helping SMEs to Recover

Agus Rachmadi, Director of BRI Microfinance Center, said that Covid-19 caused around 60.52% of MSMEs to experience a decline in sales, even 7.01% no sales at all, and 77.45% of MSMEs experienced a decrease in demand. However, entering the new normal era, economic activity in the centers of MSMEs has begun to revive, so that support is needed to accelerate the recovery of business activities. For example, BRI has carried out credit restructuring for MSMEs affected by Covid-19, credit disbursement from placement of state funds, MSME loans with guarantees, and interest subsidies.

In supporting the acceleration of recovery for MSMEs, BRI also continues to make breakthroughs, including by launching a new loan scheme called Kupedes Bangkit, to help existing BRI micro customers who are experiencing a decline in business and need additional working capital, in order to face the transition to a new normal. Then there are BRImobile, BRIspot (faster loan application process), and pasar.id (transformation of traditional markets into digital markets) which are already being used by 16,000 traders in 3000 traditional markets.

“BRI also carries out digital innovations, including core digitization (digitizing services and business transactions / processes in the form of network optimization, integrating digital operations, simplifying and standardizing the system). BRI builds a digital ecosystem (presenting a digital platform for business products and services, creating new business models, and partnering with fintech). Then there is the new digital proposition (creating and launching an independent green field digital bank in Indonesia) in the form of a mobile first channel, fully digital for an untouched market, and building capabilities for new digital,” Agus concluded his session. (hjtp)

(am)