MAKSI-PPAk Public Lecture. FEB UI, Overview of EU Fintech Market: Creativity, Key Regulatory Challenges and Aftermath of Wirecard Scandal

Rifdah Khalisha – Public Relations FEB UI

DEPOK – (6/7/2022) Master of Accounting – Professional Accountant Education (MAKSI-PPAk.) FEB UI jointly held a public lecture entitled “Overview of EU FinTech Market: Creativity, Key Regulatory Challenges, and Aftermath of Wirecard Scandal” on Wednesday (6/7). Presenting the speaker is Prof. Dr. Muhammad Ashfaq, M.B.A. (Academic Director International Program Director: Digital Business) and host Dian Tauriana Siahaan, Ph.D. (Lecturer at the Department of Accounting FEB UI).

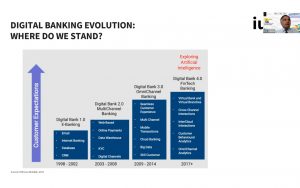

Ashfaq talked about the evolution of digital banking, starting from Digital Bank 1.0 E-Banking (1998-2002), Digital Bank 2.0 Multichannel Banking (2003-2008), Digital Bank 3.0 Omnichannel Banking (2009-2014), to Digital Bank 4.0 FinTech Banking (2017 to date) which has begun to utilize Artificial Intelligence, Big Data, and Cloud Computing.

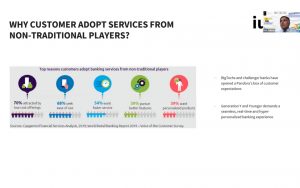

According to Capgemini Financial Services and the World Retail Banking Report (2019), customers are moving away from traditional banking services for several reasons, including being attracted by low-cost offers, seeking ease of use, wanting faster service, pursuing better features, and wanting product personalization.

Ashfaq said, “Banks are under pressure, with many executives looking to information technology departments to improve efficiency and facilitate innovation while continuing to lower costs and support existing systems.”

“Finally, Financial Technology (FinTech) Startups are venturing into established markets, leading the way with customer-friendly solutions as customers have demanded better services, seamless experiences, and more value for their money. Meanwhile, regulators are demanding more to adopt new technologies that will revolutionize the ability to collect and analyze information,” he said.

Then, regarding the presence of FinTech in the European Union, FinTech investment activity has recorded strong growth. From a regulatory point of view, regulators and supervisors need to keep up with the market to understand that the emergence of infrastructure, new players, products, and distribution channels will change the financial system.

There are several risks related to FinTech in the European Union. First, there is the risk of automating customer service and investments as competition is more severe with the entry of new companies into the financial sector.

Second, the increased growth of FinTech goes hand in hand with increased financial system vulnerabilities and cyber risks. Higher reliance on the provision of third-party services, such as communications and cloud storage, leads to higher operational risks. Moreover, the use and storage of information by FinTech raises significant privacy and data security issues.

With the rapid increase in internet access and mobile device usage, customer expectations have reached a high level in the financial sector. Consumers now expect financial services that are fast, fun, easily accessible from anywhere, and user-friendly.

According to Ashfaq, technological developments and rising customer expectations are driving new needs in the financial sector. Digital transformation is essential to attract customers and increase the loyalty of existing customers.

“Now, the implementation of financial technology solutions to intelligently meet the credit needs of Small and Medium Enterprises (SMEs) with different financial options has started. In addition, banks are also changing their structures and projects to move towards digital banking in many banks,” he said, ending his presentation. (hs)