PPIE FEB UI Doctoral Promotion Examines Central Bank Digital Currency: The Drivers and Its Role for Financial Inclusion

Nino Eka Putra ~ Public Relations FEB UI

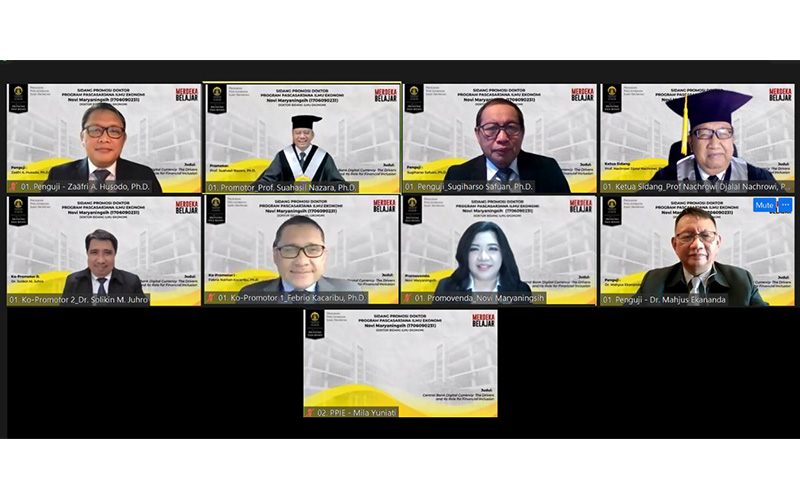

DEPOK – (27/7/2022) The Postgraduate Program in Economics (PPIE), Faculty of Economics and Business, Universitas Indonesia, held an open session of Novi Maryaningsih’s Doctoral Promotion online, Wednesday (27/7).

Prof. Nachrowi Djalal Nachrowi, Ph.D., chaired the Doctoral Promotion Session, with supervisors Prof. Suahasil Nazara, Ph.D. (Promoter), Febrio Nathan Kacaribu, Ph.D. (Co-Promoter 1), Dr. Solikin M. Juhro ((Co-Promoter 2). The examiners were Dr. Beta Yulianita Gitaharie (Chief Examiner), Sugiharso Safuan, Ph.D., Dr. Mahjus Ekananda, Zaafri A. Husodo, Ph.D., and Rino Agung Effendi, Ph.D..

In this open session, Dr. Novi Maryaningsih presented her dissertation, “Central Bank Digital Currency: The Drivers and Its Role for Financial Inclusion”. Promovenda Novi Maryaningsih researched the factors that influence the differences in Central Bank Digital Currency (CBDC) adoption progress between countries and the impact of retail CBDC implementation with interest rates as a financial inclusion tool on macroeconomic variables with a case study of Indonesia.

Empirical results from cross-country data using ordered-probit show wholesale CBDC is more advanced in countries with larger financial markets and cross-border transactions. In contrast, countries with lower financial inclusion and a large informal economy are more advanced in retail CBDC. Furthermore, the empirical results show that different factors influence developing and developed countries’ adoption of retail CBDC through sample separation. However, cross-border transactions are the most critical factor affecting wholesale CBDC adoption in developing and developed countries.

Meanwhile, empirical results using Dynamic Stochastic General Equilibrium (DSGE) show that CBDC has the potential as a means of financial inclusion. The increase in CBDC interest rates is responded to with a decrease in output and inflation. As a result, monetary policy in the period after CBDC is more effective than before CBDC. Compared to the period before CBDC, financially excluded households respond more to monetary policy.

CBDC also reduces the vulnerability of financially excluded households in the event of economic shocks stemming from labor income tax and consumption tax increases. However, government spending becomes less effective in the period after CBDC. Consumption of financially excluded households also experiences crowding out due to tax increases as a source of financing for government spending.

The Board of Directors of the open doctoral promotion session decided that Novi Maryaningsih passed with Cumlaude predicate and won the 131st Doctoral Degree in Economics. Congratulations to Dr. Novi Maryaningsih!