Budi Frensidy: 2020 Capital Market Performance Evaluation

Nino Eka Putra ~ PR of FEB UI

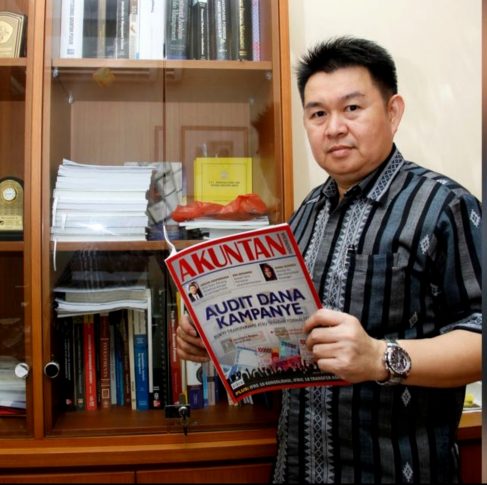

DEPOK – Monday (24/8/2020), FEB UI Professor of Finance and Capital Market, Budi Frensidy released his article, which was published in the Kontan newspaper, the Letters and Opinions rubric, page 15, entitled “2020 Capital Market Performance Evaluation”. Here is the article.

“2020 Capital Market Performance Evaluation”

August 10, 2020 is the 43rd anniversary of the Indonesian Capital Market since its reactivation by the Government of the Republic of Indonesia on August 10, 1977. This year’s 43rd anniversary carries the theme of Strengthening Capital Market Stability in the New Normal Era. The Financial Services Authority (OJK) and the Securities Regulatory Organization (SRO) are confident that in this era of adapting to new habits, Indonesia’s economic growth will regain its momentum and the stability of the Indonesian Capital Market will continue to strengthen.

A series of activities were held virtually to celebrate this anniversary, including the opening of trading on the Indonesia Stock Exchange (IDX) accompanied by the launch of e-IPO, e-Proxy, IDX Quality30 index, road map or roadmap of the Islamic Capital Market, online seminars (webinars) with the theme Covid-19, Current Challenges and the Future of Financial Market, virtual competition for the public, 10 Days Challenge in the form of challenges in opening a stock securities account, Indonesia Capital Market Got Talent, Capital Market Summit & Expo, CEO Networking, e-competitions , and Capital Market Fun Day.

This celebration is expected to increase public awareness of the capital market industry as well as a momentum to commemorate the history of the Indonesian capital market in the midst of an economy and the Composite Stock Price Index (IHSG) that is under severe pressure due to the impact of the pandemic.

For the first time in 22 years, our country’s economy will experience a contraction. However, we are not alone. Almost all countries experienced negative economic growth this year.

In line with the slowdown of our economy, our JCI slumped 37.5% year-to-date (ytd) on March 24, from 6,300 to 3,938. The LQ-45 index fell even further, namely 44.1% from 1,014.5 to 566.8. There were many downward auto rejects (ARB) that month, which was experienced by not only small cap stocks, but also our four largest cap banks. Never before at the same time there was no bid for the shares of PT Bank Central Asia Tbk (BBCA), PT Bank Rakyat Indonesia (Persero) Tbk (BBRI), PT Bank Mandiri (Persero) Tbk (BMRI), and PT Bank Negara Indonesia (Persero) Tbk (BBNI).

The phrase that the storm must pass is true. Investors’ panic in the stock market has slowly subsided. The various strategies for economic recovery that have been and are being implemented by the government have added to the confidence of investors. Optimism spreads together with positive news of clinical trials to find a Covid-19 vaccine. The JCI also left a psychological figure of 5,000 and was at 5,273 on 19 August. The number of domestic retail investors exceeded 1.2 million people or 97.6% of total share accounts and controlled 98% of 3,022,366 Single Investor Identification (SID) as of the end of July 2020. Even though at the end of last year the total SID was still less than 2.5 million.

Ownership of domestic investors in the stock market has now surpassed foreign investors. In July, domestic investors controlled 71.8% of trade. For the first time, the transaction value of retail investors’ shares exceeded those of institutional investors in June 2020. On June 8, 2020, retail investors even recorded the highest transaction value, namely IDR 7.2 trillion with a volume of 10.53 billion shares from 742,000 times the frequency compared to IDR 4.3 trillion with 3.31 billion shares and 184,000 times the frequency of institutional investors.

The impact of Covid-19 also affected mutual fund performance, marked by a decrease in net asset value (NAV) of 4.84% from IDR570.51 trillion at the beginning of the year to IDR542.88 trillion on August 6. However, we need to appreciate the OJK, which issued 82 effective statements on registration statements for 90 emissions with a total public offering value of IDR 55.956 trillion until August 7, 2020.

The development of the Islamic capital market is also encouraging. Of the 459 sharia securities in the form of shares listed in DES as of August 7, 2020, there are 443 IDX shares that are constituents of the Indonesian Sharia Stock Index (ISSI). For corporate sukuk, there was an increase in the issuance of corporate sukuk, namely 253 sukuk with a total value of Rp. 51.89 trillion, compared to last year with 232 sukuk valued at Rp. 48.24 trillion.

The number of Islamic mutual funds has also increased from 265 to 282 as of August 7, 2020. Sharia Capital Market Supporting Institutions and Professionals are also growing. The Capital Market Sharia Expert (ASPM), which numbered 92 parties at the end of last year, has increased to 113 parties as of the second week of August 2020. OJK seeks to develop the Islamic capital market through various strategies including the preparation of a Sharia Capital Market module as university learning material and the preparation of the 2020-2024 Islamic Capital Market roadmap.

In the field of law enforcement, OJK has examined 84 cases, namely 9 cases related to investment management, 39 cases regarding securities transactions and institutions, and 36 cases of issuers and public companies. OJK has issued 389 sanctions in the form of 186 written warnings, 2 license suspension, 7 license revocation, and 194 administrative sanctions in the form of fines with a total fine of Rp9.58 billion.

Behind the increasing investor confidence and performance above, our capital market is still facing classic challenges, namely the small percentage of the population who has SID compared to more than 100 million bank account numbers and the low market capitalization of new issuers.

There are 29 additional new issuers this year. However, the issuance value was only Rp3.3 trillion, much smaller than the same period last year, which was Rp8.5 trillion from 29 listed companies as well. This shows that more and more small and medium scale companies are using the capital market as a source of financing.

Of the 29 new issuers this year, only 5 main board issuers, namely those with net tangible assets above Rp100 billion. Others, 3 issuers on the acceleration board and 21 are listed on the development board with net asset values ranging from Rp1 billion to Rp100 billion. Dirgahayu RI 75th and BEI 43rd. (hjtp)

Source: Kontan Newspaper. Edition: Monday, 24 August 2020. Rubric for Letters and Opinions – Opinions. Page 15.

(am)