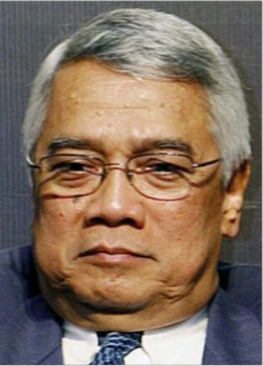

J Soedradjad Djiwandono: The National Debt Burden

Nino Eka Putra ~ PR of FEB UI

DEPOK – (7/10/2020) Professor Emeritus of Economics, Faculty of Economics and Business, Universitas Indonesia, J Soedradjad Djiwandono, released a writing published in Kompas Daily, Opinion rubric, page 6, entitled “National Debt Burden”. Following is the writing.

“National Debt Burden”

Discussions on debt burdens – whether household debt, private corporations, state-owned enterprises, government, and national debt – have always attracted attention.

This topic has also recently reappeared in connection with the need for funds to handle the swelling Covid-19 pandemic. I followed a number of analyzes, including the writing of Ginanjar Kartasasmita (Kompas, 11/9) which was very detailed and clearly explained the relevant issues to support his message for the government to be careful.

I want to discuss the side that has not been touched on and I think it is relevant to support the message to always pay attention to the careful management of debt or national loans. One of them is regarding the ratio of debt to gross domestic product (GDP), which actually has not been properly constructed.

Today, we understand that debt is a part of life that all economies, businesses and households take advantage of. In fact, banks rely a lot on their operations. Among financial economics, academics Loans are called bankers’ new clothes. Prof. Admati from Stanford and Prof. Hellwig from Bonn co-authored a 2014 book using those words. The title was followed by a subtitle I translated as “what’s wrong with banking and how to fix it”.

Is our debt safe?

For the national or state economy, the measure commonly used to determine whether a loan is secure is to look at the ratio of total debt and income (GDP). The European Economic Community, since adopting the euro as a common currency, agreed to the Maastricht Treaty in 1999 which requires that member state government loans be limited to a maximum of 60 percent of GDP, while the budget deficit is no more than 3 percent. Today, Indonesia’s ratio of around 30 percent is used as an argument that the government’s loans are still secure.

Why is the construction of this ratio less precise? In economic analysis, we distinguish the concepts of stock and flow, supply and flow. The first is a variable that measures the accumulation of an economic variable from one point in time to another. While flow measures the magnitude of these variables per unit of time. Stocks usually indicate the time when measurements were taken, usually the end of a period. For example, our national rice stock was 3 million tons at the end of December 2019. Meanwhile, the flow rate is indicated by the size of each time chosen, for example, the flow of money in Indonesia is more than IDR 5,000 trillion per month.

Therefore, in recording government or national debt; the total sum of government, BUMN, private, and household debts is calculated using the stock concept. For example, the position of foreign debt at the end of the second quarter of 2020 was recorded at USD 408.6 billion. Meanwhile, GDP is a measure of flow, how much is all income per quarter or per year. GDP is the sum of all expenditures or income per time, quarter, or year. Therefore, it is not accurate if the measure of debt security is seen from the ratio between total debt (stock) and GDP (flow).

However, this is also not a vital fallacy as the two are clearly related. GDP as flow at the end of a period, quarter or year, is the sum of flows during the measurement period. Of course, the amount of the flow of funds for a certain period, for example one year, is related to the total amount (stock). However, for debt management, what matters is the flow, not the stock. Therefore, the loan to GDP ratio is actually the ratio between the amount of stock and flow, it is less appropriate to use.

If you want to make the right ratio, debt should be compared to total national assets. However, the national assets may only be visible at the time of the census and this is not done every year, let alone every quarter.

I myself became more aware of this and only used it in 1997 when I had to deal with the financial crisis facing a very drastic depreciation of the rupiah starting April 1997. When checking the national debt figures, the notes available at BI were the number of short, medium, and long-term loans, compiled from a business world report. This data is obviously important, but not what I need when it comes to managing national loans. What I need is how much debt tomorrow, one month, one quarter, or one more year is due so that the payment can be prepared for each due date.

As the Governor of BI, along with members of the BI Board of Directors at that time, I had to ask the Minister of Industry to gather businessmen to report to BI how much their exposure abroad in foreign currency with details of maturity.

I guess I wasn’t the only one who just realized when it was too late. The IMF also seemed to have just realized when Indonesia, Thailand and South Korea invited them to create a program to handle the Asian financial crisis through stand-by arrangements. Only since the crisis has there been more attention given to calculating the ratio of short-term loans and their relation to the availability of foreign exchange reserves, both of which are stocks, so the ratio is the correct way of arranging them. However, what is more commonly used is still the loan to GDP ratio.

What should always be remembered is that the debt-to-GDP ratio is only an estimate which should be used as an estimate, not seen as a solid basis for determining the security of the amount of loan. If all the debt is to finance consumption, the ratio is between the two stock variables. What is calculated in GDP is the remainder of all the income generated in one period minus the consumption which is accumulated in one quarter or one year. So, it is related to the loan amount in terms of stock, but not directly, so the ratio is precisely indicated.

Bigger pegs than poles

The other is the connection with turmoil that can develop into a financial crisis. In the literature on financial crises there has never been only one opinion on the origin of the crisis. President Reagan’s comment, which was half insinuating to economists, read: “I need an economist with one hand”. This is a joke criticism of economists who like to answer questions by saying on the one hand…, on the other hand….

Economics is not hard science as some economists think. However, in explaining the onset of the financial crisis, it can be said that all the economists who studied it supported the hypothesis that crises were always related to highly leveraging in the previous period. Simply put, we define it as living “bigger pegs than poles”, relying on loans for the cost of living that is too large, in time will cause a crisis. The crisis in the Old Order era with inflation of around 635 percent due to a large budget deficit was financed by printing money (deficit financing).

However, the money is debt securities of the monetary authority (central bank) to all of its holders. The 1997/1998 crisis was basically due to excessive private (including foreign) borrowing. The 2008 global crisis began with the crisis in the US because mortgage loans for housing and property were out of control and became systemic after the bankruptcy of megabank Lehman Brothers.

Finally, using or comparing the measure with other more developed countries is similar to the life of the poor using the measure of the rich. Rich people who came from rich families can survive a long time without having to work and still live lavishly. This is not the case for the poor, even if they have income as a day worker, for example, their position is different from that of the rich in the eyes of other parties, especially lenders. That’s a message to remember so that we can be more careful. (hjtp)

Source: Kompas Daily. Edition: Wednesday, 7 October 2020. Opinion Rubric. Page 6.

(am)