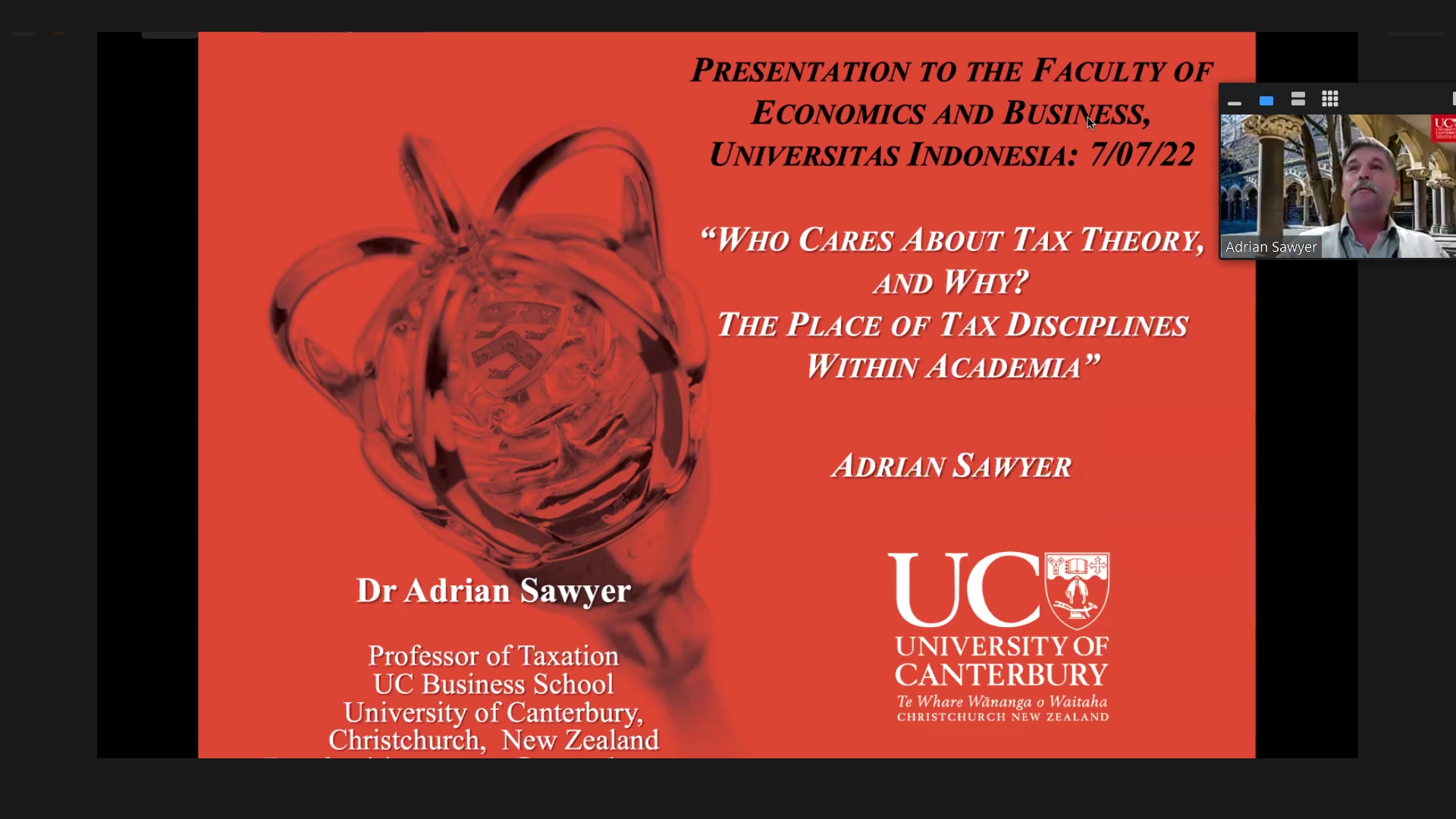

Tax Research Sharing Session, Who Cares About Tax Theory and Why? The Place of Tax Disciplines within Academia

Rifdah Khalisha – Public Relations FEB UI

DEPOK – (7/7/2022) The Department of Accounting, together with LPEM (Institute for Economic and Social Research) and Tax Education and Research Center (TERC) FEB UI, held a Tax Research Sharing Session on the topic “Who Cares About Tax Theory and Why? The Place of Tax Disciplines within Academia” on Thursday (7/7).

Presenting the speaker is Prof. Adrian Sawyer (Professor of Taxation Department of Accounting and Information Systems, University of Canterbury, New Zealand) and host Yulianti Abbas, Ph.D. (Chair of the Department of Accounting FEB UI).

Adrian says, “The truth is that tax is not just in a particular discipline. Taxation has been part of society for thousands of years, and academics’ interactions with it vary widely across disciplines.”

“We should not underestimate the influence of taxation on society because there is no other branch of law that touches human activities in so many ways as tax law does. Relevantly, taxation has an influence on almost every form of economic activity and people’s behavior,” he added.

The majority, of course, often view taxation as a ‘specialization’ within the disciplines of law and accounting. Tax is not a discipline but a multidisciplinary research field or grouping of research interests. The tax has contributed to various disciplines, including economics, philosophy, history, sociology, psychology, and public policy.

Taxation is much more than just interpreting and applying laws. In fact, academics often approach taxation from a perspective that focuses on interdisciplinary behavior.

The Tax Discipline from a Teaching Perspective

Adrian discusses views of the tax discipline. First, from a teaching perspective. Tax as a discipline or field of study is usually included in the qualification for a bachelor’s degree in higher education. Often as a compulsory service course that supports other majors, such as accounting.

Tax is an advanced elective course in other cases, such as law. Typically, students take tax discipline as support for other commercial law courses.

Outside of accounting and law, the tax discipline is covered as part of the public finance course in the economics and finance discipline. Tax can also be included in other disciplines by forming a component in a course, for example, the disciplines of history, psychology, and sociology.

Tax Discipline from a Research Perspective

Second, from a research perspective. According to Adrian’s disclosure, research in the context of tax should be seen as more than just studying the revenue law and its interpretation.

“We have to look at tax in a broader context. Most of the early research in the tax discipline has been applied in nature, such as analyzing the implications of cases for the development of aspects of tax law, with more recent research. Typically, it combines theory and testing in an empirical setting.”

“Some excellent examples of such research can be seen in the Doctoral Series publications of the International Bureau of Fiscal Documentation (IBFD) and the Australasian Tax Teachers Association (ATTA),” he added.

Research in the tax discipline is dominated by its application in law and accounting, economics, history, political science, psychology, and sociology. In many ways, this reflects the discipline to which the researcher belongs. For example, legal tax academics often use traditional legal methodologies, such as black letter law. (mh)